In response to the deal, hkex said it was not a hostile takeover but a purely UK shareholder transaction. Responding to questions about the nature of the Hong Kong stock exchange and the political considerations behind it, Mr. Li pointedly said, "Hong Kong stock exchange is a global company." But in its rejection, the lse pointed out that hkex's demand that lse abandon its bid for rover was not in line with its original intention of strategic transformation. The deal, which will also face full scrutiny from regulators in Europe and the us, is highly uncertain and will put lse shareholders at high risk, complicating matters by the exchange's relationship with the Hong Kong government.

Earlier, Hong Kong stock exchange chief executive Charles li sent a message explaining the importance of a series of "marriage proposals" to the London stock exchange, including repeated references to the "internationalisation of the renminbi". He pointed out that under the background of the internationalization of the RMB and the gradual opening of the capital account, the internationalization of the RMB driven only by trade pricing in mainland China also encountered a short-term bottleneck. Therefore, access to direct international financial market support is now critical. At the same time, London can also benefit from the process that the RMB gradually becomes the world's major international currency and the financial assets denominated in RMB gradually enter the international market.

The city of London and the People's Bank of China's European office have jointly released the London renminbi business quarterly report, which shows that London continues to flourish as an offshore renminbi centre in the face of brexit's drag on the UK's economic growth. In the fourth quarter of 2018, the average daily trading volume of RMB in London was 76.6 billion pounds, up 45% year-on-year. At the same time, cross-border revenues and payments between China and the UK have also seen significant growth, reaching about 29.9 billion yuan in February 2019, up about 50% year-on-year.

According to the announcement, the Hong Kong stock exchange decided to adopt a "cash plus private placement" approach to acquire all the share capital of the London stock exchange.,the latter's shareholders, of 20.45 pounds per 1 shares available and 2.495 shares in the Hong Kong stock exchange, for about 29.6 billion pounds (about hk $286.7 billion), compared with the previous trading day's closing price the London stock exchange a 23% premium. Upon completion of the acquisition, all shares held by lse shareholders will be converted into shares held by hkex. Shares in the London stock exchange group rose as much as 16 percent on the news before closing up 5.91 percent.

While the UK economy continues to be Mired in unprecedented uncertainty due to brexit, London remains the largest offshore center for the renminbi. At the end of last year, trading in the yuan in London surpassed trading in the pound against the euro, a sign that investor confidence in holding the yuan remains strong. Therefore, it can be predicted that London will continue to support RMB internationalization in the future.

(Picture Source:Baidu)

In June this year, China and the UK issued a joint announcement, approving in principle the Shanghai stock exchange and the London stock exchange to carry out shanghai-lungtong business. Under the shanghai-lunlun stock connect mechanism, qualified dual-listed companies can issue DR in accordance with the laws and regulations of the other market and trade in the other market.

After being rejected by the London stock exchange, hkex replied that its board continued to view the proposed merger with the London stock exchange group as a significant strategic opportunity for mutual benefit and win-win results and to create a leading global financial market infrastructure. Hkex believes lse shareholders should have the opportunity to analyse both deals in detail and will continue to approach them.

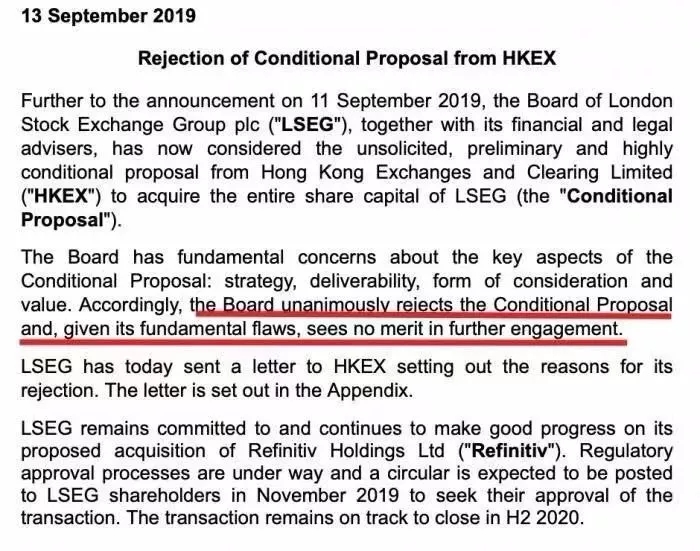

On the night of the Mid-Autumn festival, two of the world's biggest exchanges rejected a proposed "marriage". The London stock exchange group on the evening of September 13 Beijing time issued a statement, rejected the Hong Kong stock exchange public offer.

But the lse slapped hkex in its rejection, saying: "we recognise the scale of the opportunities in China and value our relationship there. However, we do not believe that hkex offers us the best long-term positioning in Asia or the best listing/trading platform in China." "We value our mutually beneficial partnership with the Shanghai stock exchange, which is our preferred and direct channel for many of our opportunities to engage with China." The London stock exchange's courtship of the Shanghai stock exchange is not surprising. In recent years, China and the UK have implemented financial innovation measures one after another. The move follows China's choice of London as the first offshore centre for the renminbi in the west, which has spurred Europe's openness to the internationalisation of the renminbi.

Hong Kong and London, home to the two exchanges, are also facing one of the biggest crises in their history, with Britain at a critical juncture in its exit from the European Union and London's centuries-old status as a leading financial centre in question. At the same time, the recent social situation in Hong Kong is also very turbulent. Hkex is the world's third largest exchange group by market capitalisation, with activities in equities, commodities, fixed interest and currency markets. It is the only stock and derivatives exchange in Hong Kong and the only clearing house operator in Hong Kong. Companies have long topped the global market for initial public offerings. In fact, this is not the first time in recent years that they have made such a large acquisition. In 2012, hkex paid £1.388bn for the 142-year-old lme, its only overseas acquisition to date.

Meanwhile, the London stock exchange said it would continue to buy Refinitiv, a financial data technology company, in a deal worth £270m. A condition of the Hong Kong exchange's earlier proposal was that lse end its bid for rover. In its rejection, the lse also cited "fundamental concerns" about key elements of the hkex proposal, and even suggested that hkex's valuation of the lse was "significantly too low". At the same time, the lse added, 'we recognize the great opportunities in China and attach great importance to our relationship. Attach importance to mutually beneficial cooperation with Shanghai stock exchange. There is no need to approach hkex further.